When you apply for a car loan, it’s common for the lender to perform a hard inquiry on your credit report. This inquiry can have an impact on your credit score, potentially causing it to drop by up to 30 points. It’s important to note that even a single car loan application can lead to a decrease in your credit score. Therefore, if you’ve applied for multiple loans, the cumulative effect of these inquiries could be contributing to a lower credit score.

It’s crucial to be mindful of the number of loan applications you submit, as each one can have an impact on your credit standing.

Buying a car is an exciting milestone, but it’s essential to understand the potential consequences it may have on your credit score.

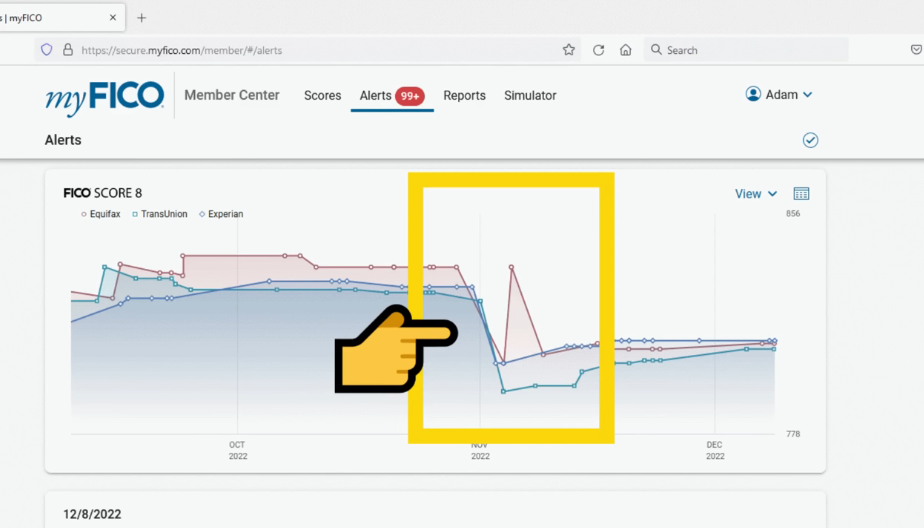

So, Why Credit Score Dropped 100 Points After Buying a Car?

While a drop of 100 points after buying a car may seem alarming, it’s important to consider the factors at play. In most cases, it’s the result of the lender’s hard inquiry and the cumulative effect of multiple loan applications.

To keep your credit score intact, it’s advisable to limit the number of loan applications you submit and be mindful of the impact they can have on your credit standing.

Understanding how car loans can affect your credit score is key to making informed financial decisions.

Table of contents

Why Did My Credit Score Dropped 100 Points After Buying a Car?

Several factors could contribute to a significant drop of 100 points in your credit score after buying a car. Here are some possible reasons:

Remember, credit scoring models are complex, and the specific impact on your credit score can vary depending on your unique credit profile and the scoring model used.

Monitoring your credit report and practicing responsible credit management, such as making payments on time and keeping debt levels manageable, can help you maintain or improve your credit score over time.

The Impact of Car Loan Applications on Credit Score:

When you apply for a car loan, it’s important to understand the potential impact it can have on your credit score. Here are a few key points to consider:

To summarize, applying for a car loan can potentially cause your credit score to drop, especially if you have multiple loan applications or if you don’t make timely payments. It’s essential to be cautious and mindful of how your loan applications might affect your credit standing.

| Key Points |

|---|

| – A single car loan application can decrease your credit score by up to 30 points. |

| – The cumulative effect of multiple loan applications can contribute to a lower credit score. |

| – Car loans can increase your credit utilization, which may negatively impact your score. |

| – Timely payments on your car loan can have a positive impact on your credit score. |

Understanding Hard Inquiries and Credit Score:

When you apply for a car loan, the lender will typically conduct a hard inquiry on your credit report. This is a necessary step for them to evaluate your creditworthiness and determine the terms of the loan.

However, it’s important to understand how these inquiries can affect your credit score.

Here are a few key points to consider:

| Key Points |

|---|

| – A single car loan application can decrease your score by up to 30 points |

| – Multiple loan applications can further lower your credit score |

| – Be mindful of the number of applications you submit |

| – Inquiries made within a 45-day period are counted as a single inquiry |

| – Regularly monitor your credit report for accuracy |

Cumulative Effect of Multiple Loan Applications:

When it comes to buying a car and financing it through a loan, there are some important things to consider regarding your credit score.

One significant factor to be aware of is the cumulative effect of multiple loan applications. Here’s what you need to know:

Impact on Your Credit Score:

Each time you apply for a car loan, the lender will conduct a hard inquiry on your credit report.

While a single application may only cause a minor decrease in your score, the cumulative effect of multiple inquiries can have a more significant impact.

It’s crucial to keep in mind that your credit score can decrease by up to 30 points with just one car loan application.

Lower Credit Standing:

If you’ve applied for multiple loans within a short period, these inquiries can contribute to a lower credit score. The more loan applications you submit, the greater the potential impact on your credit standing.

This is because lenders may perceive you as a higher risk borrower, as multiple loan applications may indicate financial instability.

Be Mindful of Your Applications:

To avoid a significant drop in your credit score, it is advisable to be mindful of the number of loan applications you submit. Here are a few tips to consider:

Remember, your credit score is an essential aspect of your financial health. Taking proactive steps to manage and protect it will benefit you in the long run.

| Single Loan Application Impact | Up to 30 points decrease in credit score |

| Cumulative Effect of Multiple Applications | Higher risk perception by lenders |

| Tips to Consider | Research and compare loan options, limit applications, time them strategically, monitor your credit report regularly |

Being Mindful of Loan Application Numbers:

When it comes to applying for loans, it’s important to be mindful of the number of applications you submit.

Each application can have an impact on your credit standing, potentially causing your credit score to decrease. Here are a few key points to consider:

The Impact of Hard Inquiries:

When you apply for a car loan, the lender will typically conduct a hard inquiry on your credit report.

This inquiry is a request for your credit history and can affect your credit score. It’s important to note that a single application for a car loan can potentially cause your score to decrease by up to 30 points.

Cumulative Effect of Multiple Inquiries:

If you’ve applied for multiple loans, the cumulative effect of these inquiries can contribute to a lower credit score.

Each time a lender conducts a hard inquiry, it leaves a mark on your credit report. So, the more loan applications you submit, the greater the potential impact on your credit standing.

The Importance of Moderation:

To maintain a healthy credit score, it’s advisable to be mindful of the number of loan applications you submit. Here are a few tips to keep in mind:

| Number of Loan Applications | Potential Decrease in Credit Score |

|---|---|

| 1 | Up to 30 points |

| 2 | Cumulative effect of inquiries |

| 3 or more | Further decrease in credit score |

Conclusion and final thoughts 💭

It is clear that applying for a car loan can have a significant impact on your credit score. Here are the key takeaways from this article:

- Hard inquiries can cause a decrease in your credit score: When you apply for a car loan, the lender will typically conduct a hard inquiry on your credit report. This inquiry can result in a decrease in your credit score, typically by up to 30 points.

- Multiple loan applications can compound the impact: If you have applied for multiple loans, the cumulative effect of these inquiries can further contribute to a lower credit score. It is essential to be mindful of the number of loan applications you submit to avoid unnecessary negative impacts on your credit standing.

- Be cautious with loan applications: Given the potential impact of loan applications on your credit score, it is crucial to be cautious when applying for loans. Only apply for loans that you genuinely need and are confident you can manage responsibly.

- Monitor your credit score: Regularly checking your credit score is essential to stay aware of any changes or potential issues. You can utilize free credit monitoring services or check your credit report annually to ensure accuracy and address any discrepancies promptly.

- Maintain a healthy credit profile: While a decrease in your credit score due to a car loan application is temporary, it is still essential to maintain a healthy credit profile overall. Make timely payments on all your debts, keep credit card balances low, and avoid taking on excessive debt.

By understanding the impact of car loan applications on your credit score and taking steps to manage them responsibly, you can maintain a healthy credit standing and make informed financial decisions.

Leave a Reply