If you’re planning a road trip or renting a car for your next vacation, one question that might be on your mind is whether or not your Visa credit card provides rental car insurance.

To find out the answer to this common query, I decided to go straight to the source and ask Visa themselves.

So, Does Visa Cover Rental Car Insurance?

Answer Is Yes, most Visa signature cards provide secondary coverage for rental car insurance by covering collision damage and theft up to the actual cash value of rental vehicles for trips up to 31 days when booking entirely with an eligible Visa card.

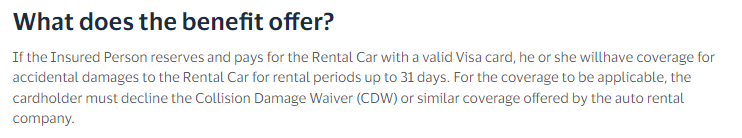

I asked them and here’s there response in the below image 👇:

In this article, we’ll explore what I learned from my conversation with Visa and provide you with all the details you need to know about whether or not your Visa card covers rental car insurance. So let’s dive in and uncover the truth!

Table of Contents

Does Visa Cover Rental Car Insurance?

Many Visa signature cards provide secondary rental car insurance as a cardholder benefit. This means your Visa card’s coverage kicks in after your primary auto insurance policy to cover damage to or theft of a rental vehicle.

The coverage applies when you use your eligible Visa card to secure and completely pay for the entire rental car transaction.

It covers collision/damage to the rental vehicle from accidents or vandalism, as well as theft of the vehicle, often up to the car’s actual cash value.

Visa’s rental coverage is secondary to your personal or business auto insurance policy’s protection.

If you don’t have your own car insurance or your policy does not extend to rental cars, then Visa’s benefit becomes your primary insurance in case of theft or damage when renting for eligible purchases.

Most Visa rental car insurance benefits are valid for rental periods of 31 days or less. The coverage only applies to rental vehicles leased at acceptable merchants that provide collision damage waivers and meet Visa’s policy guidelines.

Off-road vehicles, antique cars, and other exclusions may apply. Be sure to check your Visa card’s specific rental coverage benefits and exclusions before declining additional policies offered by rental companies.

So in summary – yes, having a Visa credit card with built-in rental car insurance perks can provide a backup layer of coverage against rental vehicle damage or theft as long as you meet all eligibility requirements. Checking details with your specific Visa card provider is always advisable.

How Does Visa Rental Car Insurance Work?

When it comes to rental car insurance, Visa offers a certain level of coverage for cardholders. Here’s how their rental car insurance works:

Eligibility:

To be eligible for Visa rental car insurance, you must:

Types of Coverage:

Depending on your specific Visa card, you may have access to different types of coverage, including:

Coverage Limits:

Each type of coverage has its own limits that vary depending on your specific Visa card. It’s important to check your card’s terms and conditions to understand these limits.

Exclusions:

While Visa provides valuable rental car insurance, there are some exclusions worth noting:

- Certain expensive or exotic vehicles may not be covered.

- Vehicles rented in certain countries may also be excluded from coverage.

Claims Process:

If an incident occurs during your rental period and you need to file a claim with Visa, here are general steps involved in their claims process:

- Contact the Benefit Administrator within a specified timeframe (usually within 45 days).

- Provide all necessary documentation such as accident reports and repair estimates.

- Await review and approval from Visa before receiving reimbursement.

Remember that each individual credit card issuer may have slight variations in their policies regarding rental car insurance.

It’s always recommended to review the terms and conditions provided by your specific Visa card or contact their customer service for more information on coverage details.

Overall, it’s important to have a clear understanding of how Visa rental car insurance works before relying solely on this coverage when renting a vehicle.

What Are the Coverage Limits?

When it comes to rental car insurance coverage limits offered by Visa, there are a few important factors to consider. Here’s a breakdown of what you need to know:

Collision Damage Waiver (CDW)

- Visa provides coverage for physical damage and theft of most rental vehicles.

- The coverage is secondary, meaning it kicks in after your personal auto insurance policy and any other applicable insurance.

Coverage Limit

- The maximum amount covered under Visa’s CDW is typically limited to the actual cash value of the vehicle at the time of loss or damage.

- It does not include any additional costs such as administrative fees, loss-of-use charges, or towing expenses.

Excluded Vehicles

- Certain types of vehicles may be excluded from coverage, such as luxury cars, antique cars, vans designed to carry more than 8 passengers, trucks weighing over 10,000 pounds gross vehicle weight rating (GVWR), and motorcycles.

Country Restrictions

- Coverage varies by country.

- Some countries may have specific restrictions or exclusions that apply.

Rental Period Limits

- There might be limitations on the duration of coverage provided by Visa.

- For example, some cards may only offer coverage for rentals up to 15 consecutive days.

Card Type Differences

- Different types of Visa cards might provide varying levels of rental car insurance benefits.

- It’s essential to check with your card issuer about specific terms and conditions that apply.

Remember that these details are based on general information provided by Visa but can vary depending on your specific credit card agreement and country regulations.

To get accurate information about your own coverage limits and terms, reach out directly to your credit card provider before renting a car using their benefits.

Which Countries are Covered by Visa Rental Car Insurance?

When it comes to rental car insurance coverage, it’s essential to know which countries are included in your Visa benefits. Here’s a breakdown of the countries covered by Visa rental car insurance:

While this list includes a wide range of countries where your visa card provides rental car insurance benefits; it is important always double-check with your specific credit card provider for any country exclusions or limitations that may apply before renting a vehicle abroad.

Are There Any Exclusions or Exceptions to the Coverage?

When it comes to rental car insurance coverage offered by Visa, there are a few important exclusions and exceptions that you should be aware of.

While Visa provides valuable protection for many situations, it’s essential to understand the limitations of their coverage. Here are some key points to keep in mind:

Remember that these exclusions and exceptions can vary depending on the specific terms and conditions outlined by each credit card issuer offering rental car insurance.

It’s always a good idea to review your card’s policy thoroughly or contact the credit card company directly for clarification on any doubts you may have.

Please note that this information is accurate as of the time of writing, and it is advisable to check with Visa or refer to their official documentation for up-to-date and detailed coverage information.

How to File a Claim for Visa Rental Car Insurance?

If you find yourself in a situation where you need to file a claim for Visa rental car insurance, follow these steps:

Remember that each credit card company may have slightly different procedures when it comes to filing a claim for rental car insurance coverage under Visa benefits. Be sure to familiarize yourself with their specific requirements before starting this process.

Conclusion and final thoughts

After reaching out directly to Visa for clarification on whether they cover rental car insurance, the answer is clear: no, Visa does not provide rental car insurance coverage.

It is essential for individuals planning to rent a vehicle to understand that relying solely on their Visa card for insurance protection may leave them vulnerable in case of an accident or damage.

While some credit cards offer benefits such as collision damage waiver (CDW) or loss damage waiver (LDW), it is crucial to read the fine print and know the specific terms and conditions provided by your credit card company.

Additionally, considering supplemental insurance options from reputable rental car companies or purchasing a separate policy can help ensure adequate coverage and peace of mind during your travels.

Reference:

https://www.visa.com.tt/pay-with-visa/find-a-card/benefits/auto-rental-insurance.html

Leave a Reply